Invest in the Next Chapter of Modern Fine Jewelry

For 12 years, Aurelia Atelier has elevated the standard of contemporary luxury, blending old-world craftsmanship with modern design. Our pieces have been featured in Vogue, Harper’s Bazaar, and Elle, and are worn by collectors and creators across the globe.

With boutiques in New York, Los Angeles, and London generating more than $18 million in annual revenue, Aurelia has become a symbol of refined, attainable luxury. As we expand into digital retail, bespoke engagement, and global partnerships, we’re projecting $50 million+ in revenue by 2027.

This is your opportunity to invest in the next chapter of fine-jewelry innovation.

Awarded by:

Vogue Highlights Our Vision

When a global style authority like Vogue takes notice, it’s a sign that your story resonates far beyond the showroom. That’s why we’re proud to share that Vogue Business recently featured Aurelia Atelier and our founder, Elena Marceau, in a segment exploring how technology and craftsmanship are reshaping the fine jewelry landscape.

The piece went deeper than design — it examined our mission to make heirloom-quality jewelry more transparent, sustainable, and accessible through our upcoming community investment round.

Outpacing the Global Luxury Market

We’re redefining what growth looks like in the fine jewelry sector — with projected annual revenue expansion exceeding 45%, nearly twice the pace of the global luxury market. Over the past five years, our sales have increased by triple digits, driven by a surge in global demand for ethically sourced, design-forward pieces that merge tradition with innovation.

Our omni-channel strategy — combining boutique retail, digital storefronts, and private client experiences — has positioned Aurelia Atelier at the forefront of a changing luxury landscape. As we scale, we’re expanding into new markets across Europe, the Middle East, and Asia, where emerging consumer bases are fueling rapid category growth.

As sales accelerate, profitability is scaling even faster. Our gross margins are projected to rise 12% year-over-year, supported by direct-to-consumer efficiencies, vertically integrated production, and a growing base of repeat collectors. By 2028, net income is expected to increase by $7.2 million, with each new product line designed to strengthen both brand equity and long-term value.

This means you’re investing in a modern jewelry house built for both scale and endurance — where craftsmanship, innovation, and strong financial performance coexist beautifully. With a proven model, disciplined expansion strategy, and a rapidly growing international following, Aurelia is poised to become one of the defining fine jewelry brands of the next decade.

A TOAST TO OUR JOURNEY

For over a decade, Aurelia Atelier has redefined modern fine jewelry — bridging the artistry of Parisian design with the precision of contemporary craftsmanship. Our collections have earned international recognition, including features in Vogue, Elle, and Harper’s Bazaar, and collaborations with leading stylists and global icons.

Our flagship line, Lumière, was named Jewelry Collection of the Year by The Luxury Edit, marking a milestone for an independent atelier. With one of the fastest-growing online communities in the fine jewelry world and a loyal following of collectors, we’ve cultivated a global audience that values both beauty and meaning.

Today, our boutiques in New York, Los Angeles, and London welcome thousands of visitors each month, with every location operating profitably. Beyond our showrooms, we’re expanding into direct-to-consumer retail, limited-edition collaborations, sustainable sourcing initiatives, and digital experiences — all positioned for exponential growth.

A Proven, Profitable Business Model

Exceptional Growth Potential

The scalability of our company positions us for a massive exit opportunity and an elevated, high-multiple valuation.

The Most Recognizable Brand

With years of operational excellence, industry-defining products, and award-winning services, we are the premiere brand in our industry.

Scalable Model

Strong partnerships and brand strength reduce initial capital requirements, enabling rapid growth in high-demand markets.

Diverse Revenue Streams

Multiple income sources position us for sustained growth and an elevated, high-multiple valuation.

Proven Success

Long-developed systems and processes have enabled successful operations in diverse markets, generating significant annual revenue.

Unmatched Marketing Engines

Backed by a large social media following, powerful PR engine, industry-leading marketplace, and engagement platforms.

Get the Investor Brief

Discover the strategy, numbers, and vision that set Aurelia Atelier apart.

We Have the Ideal Growth Strategy

Aurelia Atelier’s growth strategy is designed to maximize expansion while preserving brand integrity and financial discipline — setting a new benchmark in the fine jewelry industry. By leveraging strategic retail partnerships and selective co-investment opportunities, the majority of new boutique openings are funded through external capital, allowing Aurelia to focus resources on craftsmanship, innovation, and brand elevation.

Our hybrid retail model — combining direct-to-consumer sales, digital exclusives, and private client experiences — enables us to scale efficiently across global markets while maintaining the exclusivity that defines the brand. In parallel, licensing partnerships and collaborative capsule collections generate low-overhead, high-margin revenue streams, extending Aurelia’s reach into fashion, bridal, and lifestyle categories.

This balanced strategy — rooted in creative excellence and financial prudence — positions Aurelia Atelier for sustainable, profitable growth and ensures enduring value for our investors, partners, and collectors alike.

Our Blend of Heritage & Agility

Recognized among the most innovative independent jewelry houses, Aurelia Atelier’s legacy serves as the foundation for our modern, agile approach to expansion. Rooted in Parisian craftsmanship and guided by a philosophy of timeless design, Aurelia has built a reputation for excellence while embracing the tools and technologies shaping the next generation of luxury.

Through initiatives like our Aurelia Studio concept — a refined, gallery-style retail experience — and the Aurelia Editions line of limited, collectible releases, we’re able to reach new audiences with lower capital investment and faster market entry. Each new model is designed to minimize operational costs while maximizing creative reach and margin efficiency.

Aurelia Studio represents an evolution of our heritage brand: intimate, design-forward spaces that bring fine jewelry to emerging markets without compromising exclusivity. The demand for our presence has grown so significantly that developer and retail partners now cover up to 80% of build-out costs, enabling us to expand rapidly with minimal financial risk.

Our Global Expansion

Paris

Our flagship atelier on Rue Saint-Honoré continues to define the Aurelia experience — a symbol of craftsmanship, artistry, and timeless luxury.

New York:

Opening in Spring 2025, our Madison Avenue boutique is fully funded and positioned at the heart of Manhattan’s luxury corridor.

Dubai:

Located within The Dubai Mall Fashion Avenue, our first Middle Eastern flagship showcases limited Aurelia Editions and private salon collections, opening Summer 2025.

London:

Set to open in Knightsbridge in late 2025, Aurelia London has secured one of the city’s most coveted retail leases with partner-funded build-out.

Tokyo:

Our upcoming Ginza Gallery, featuring exclusive artist collaborations and digital showcases, is under development with local partners.

Singapore:

Launching in partnership with The Shoppes at Marina Bay Sands, this Aurelia location will anchor our expansion into Southeast Asia’s luxury retail market.

Milan:

Our first Italian atelier, opening in 2026 in the Brera Design District, celebrates the intersection of jewelry, art, and architecture.

Investor Perks

Our Next Chapter: Aurelia Maison

With the debut of Aurelia Maison, we’re extending our world of fine jewelry into a full lifestyle experience. Opening in 2026 on Paris’s Rue du Faubourg Saint-Honoré, Aurelia Maison will be our first jewelry-inspired residence and gallery, where design, craftsmanship, and culture converge.

Set within a restored 19th-century townhouse, Aurelia Maison will feature a curated retail salon, private atelier suites, and a fine jewelry lounge offering collector consultations, art collaborations, and immersive brand storytelling. Guests will be invited to experience Aurelia’s artistry in a new light — not just as adornment, but as a way of life.

Every space will reflect our brand’s ethos of timeless beauty and meaningful connection — from the marble inlays inspired by our signature designs to the scent created exclusively for the Maison. It’s the next evolution of the Aurelia vision: a place where luxury becomes deeply personal, and craftsmanship extends beyond the jewel.

Press

Frequently Asked Questions

Join The Conversation

Comments

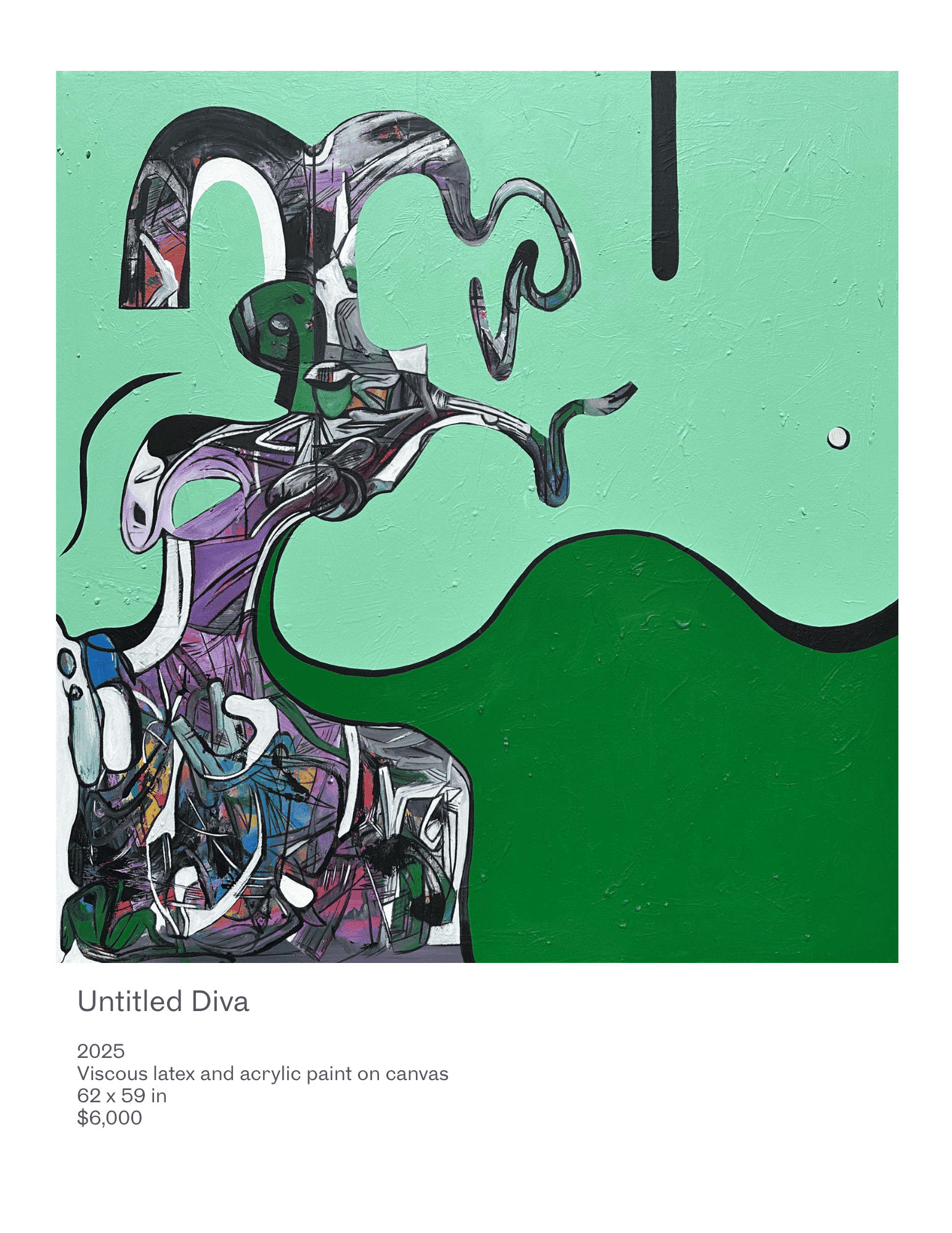

Custom Pieces For Sale

eBVSeyLPZxaUgcOGNsCqm

aRJzWtVuYheHgkbPLbIyJLAo

KvhtSMMtmtlJRzGjWO

gTovlughmkSEvxEgucsAgf

EKbMMIGYqRlcKikqdIWrwp

sfoOwYluGWjSHeGFfboOjFe

emFvRyUjyQKkdIaa

JqhlBQNosHpIzkMMI

ruEQHWNexqFoxzCYzJfL

BldsWvatUPxdEsGhFoDMZeRl

pFnJpSZnKRhTUBmtYKsBd

bpBAtyZyAIzFdwmg

CaUkXCIRXRyWpaLoF